How to estimate the new NOx charge

Please enter NOx value (displayed on the V5 Certificate) in g/km in the calculator

Note: Ask the seller for a hard copy of the V5 Certificate or to email you a copy.

Note: If you enter the NOx value in mg/km you will receive an inaccurate result.

Basis of Charge

Nitrogen Oxide (NOx) emissions will be taxable beginning on 1 January 2020. The charge is applicable to all Category A vehicles excluding electrics but including hybrids. The NOx emission bands were altered on 1 January 2021 and the new bands are available to review in the table below.

The NOx charge will be calculated by applying a per-milligramme per-kilomtere matrix to the officially recorded manufacturer emissions levels of NOx per kilometre.

The charges will be incremental and will work on a sliding scale calculating the cars NOx emissions in milligrams per kilometre (mg/km).

The scale starts at €5 per mg/km for a car’s initial 40mg/km of NOx emissions levels that are recorded against the vehicle within the bands displayed in the table below:

| NOx emissions bands | Charge |

| 0 – 40 mg/km | €5 |

| 41 – 80 mg/km | €15 |

| 81mg/km + | €25 |

| Charge will be capped at €4,850 for diesel vehicles and €600 for all other vehicles | |

The NOx charge will be a component of vehicle registration tax as outlined below:

Carbon Dioxide charge + NOx Charge = Total VRT payable.

NOx is charged on the basis of milligrams per kilometre as recorded on the Certificate of Conformity. In the case of heavy duty vehicles this will be milligrams per kilowatt hour.

Depending on documentation such as foreign registration certificates the figure may also be shown as grams per kilometre. This will not affect the tax due as Revenue will convert this to milligrams in the calculation at registration.

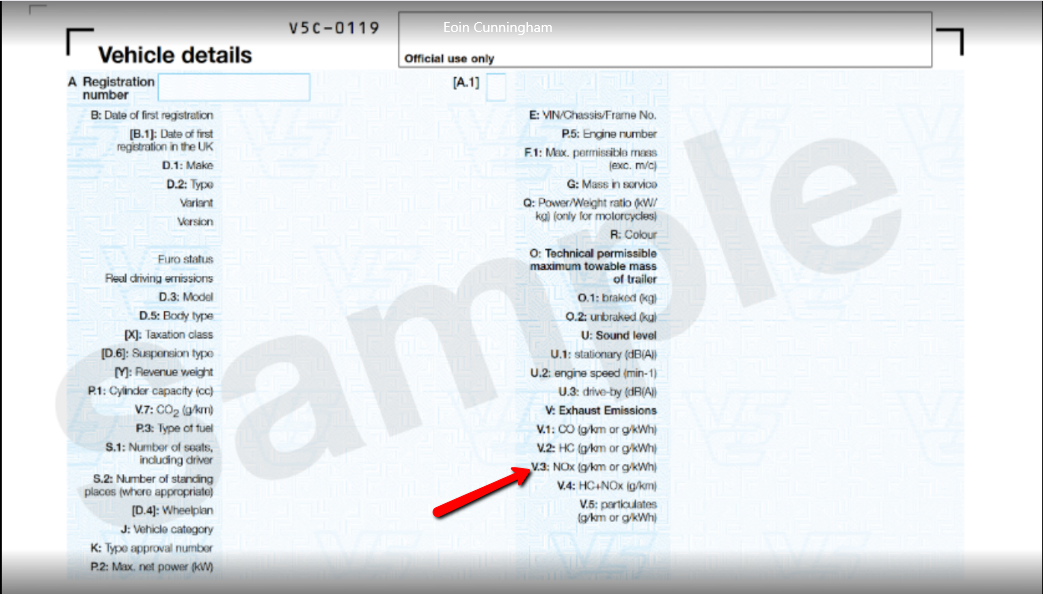

Understanding the V5 Certificate

You can find the NOx g/km figure for the vehicle in section V.3 of the form as highlighted below:

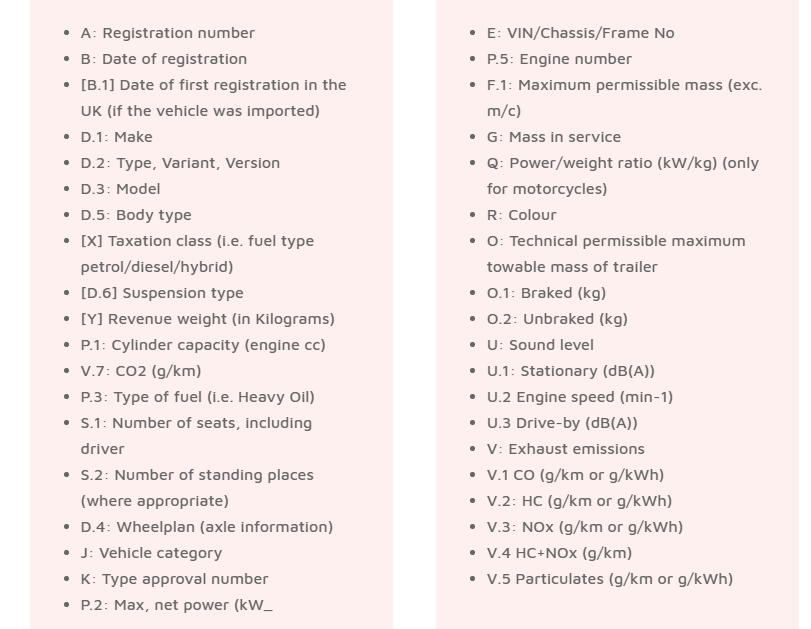

A full list of the various categories of information displayed on the V5 certificate is provided below: