Motor Tax in Ireland

With used car prices on the increase, and motorists paying close attention to motoring costs we are hearing more queries relating to the topic of “Is my car taxed?”. In Ireland motor tax is payable on almost all road vehicles (there are rare exceptions) and the owner of the vehicle is also legally obliged to display proof that they have paid this tax (the evidence being the road tax disc normally placed on the front window of the vehicle). Motor tax is generally calculated on the amount of carbon dioxide emissions associated with the vehicle in question.

You can access information on the tax status of the veicle you own by visiting motortax.ie

You will need to enter the registration number of the vehicle as well as a PIN number to access the specific information for your vehicle which includes:

- Tax band

- Cost of annual Taxation and semi-annual Taxation, quarterly Taxation

- Any arrears per month.

You will also be able to renew your motor tax if necessary.

What happens if I don’t pay my motor tax?

If you fail to display evidence that you have taxed the vehicle then you may be at risk of incurring a €60 fixed-charge fine from a Garda or traffic warden during a routine vehicle stop.

Furthermore, it’s worth noting that if your vehicle is not displaying a valid motor tax disc then it is more likely to draw attention to itself, which will in turn increase the possibility of the car being clamped or towed away.

What Motor Tax Information is Provided In A Cartell Car History Check

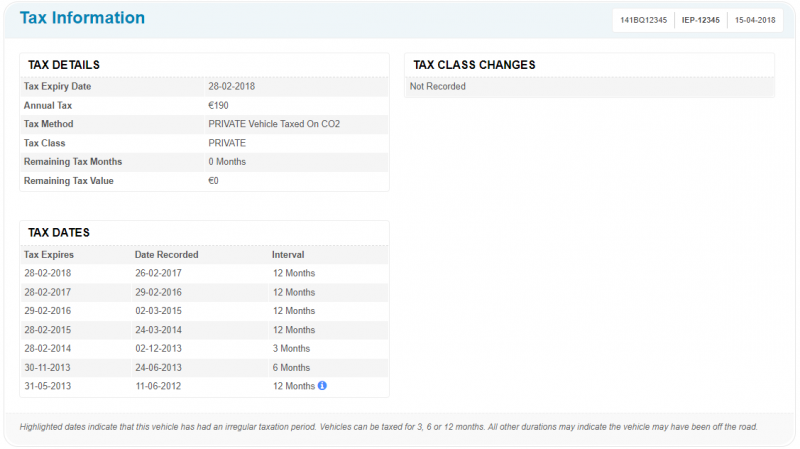

Cartell provide detailed information on the tax status of a vehicle in our car history check reports. As you can see from the image below the Cartell check will inform the buyer of a number of specific tax details for the checked vehicle. These include a list of dates on which the vehicle was taxed which can be useful in identifying any “tax gaps” when the vehicle may have been off the road for whatever reason. It is certainly worth asking the seller about any tax gaps identified, or why a car may not have been taxed in some time. Usually this could be due to the car undergoing repair or maintenance work, the car simply not being used for some time and laying idle, or it could simply have been up for sale for an extended period of time. Whatever the reason the motor tax history does sometimes provide useful clues about the unique history of the vehicle and should inform a part of your discussion with the buyer.

Example of Cartell Car History Check Tax Information

Motor Tax Scams to be Aware Of

Of course whenever money is involved, especially when it relates to something on the scale of almost every vehicle on our roads, there are motor tax scams that the public should be aware of. Some of the most common scams in recent times relate to sophisticated scam emails that purport to be coming from the Department of Transport and encourage the recipient to reveal financial details or pay arrears. The advice is to ignore any of these type of emails as it is not Government policy to request financial details or payments via email or pop-ups.

Another common motor tax scam is to simplify falsify the tax disc itself. Sometimes all it takes is a sticker or some printed copy to deceive a buyer into believing that the motor tax disc is up to date. The buyer should always be vigilant and if there are any doubts or concerns then a Cartell car history check will give you a detailed summary of the tax history of the vehicle.

So while some may regard the simple question of “Is my car taxed?” as a very basic enquiry, there are certainly steps you can take to ensure the vehicle does hold a valid tax certificate so as to prevent any possible fines or prosecution further down the line. Always inspect the tax disc closely and check the registration with verified sources like motortax.ie and of course for a full and detailed motor tax history you can always get a Cartell car history check.