Average Value of New Car in Ireland Now Over €35,000

Vehicle history and data expert Cartell.ie and car sales platform CarsIreland.ie latest data research can reveal the average value of a new car purchased in Ireland. Cartell.ie looked at the average Open Market Selling Price of all new cars purchased between January and October in every year between 2003 and 2021. The results showed that the average value for a new car purchased in 2021 was €35,199. This is the fourth year that average values have exceeded the €30,000-mark.

Chart 1 – Average Open-Market-Selling Price of New Cars purchased in Ireland 2003 to 2021 (Jan to October) Source: Cartell.ie Carstat.

| Year | Value (€) |

| 2003-11-01 | 23354 |

| 2004-11-01 | 24836 |

| 2005-11-01 | 25998 |

| 2006-11-01 | 27045 |

| 2007-11-01 | 28022 |

| 2008-11-01 | 27909 |

| 2009-11-01 | 25798 |

| 2010-11-01 | 23883 |

| 2011-11-01 | 24715 |

| 2012-11-01 | 26054 |

| 2013-11-01 | 26267 |

| 2014-11-01 | 26681 |

| 2015-11-01 | 27168 |

| 2016-11-01 | 28538 |

| 2017-11-01 | 29493 |

| 2018-11-01 | 30173 |

| 2019-11-01 | 31515 |

| 2020-11-01 | 33278 |

| 2021-11-01 | 35199 |

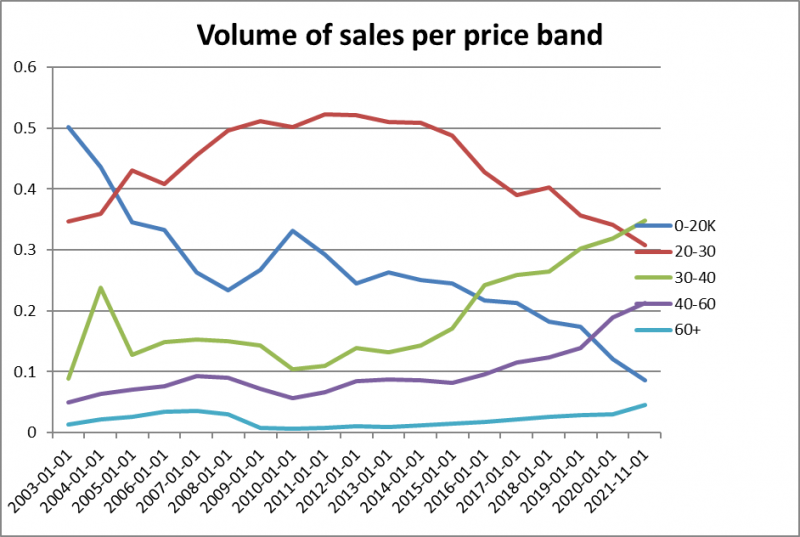

Furthermore the strongest growth in the new car market over the past number of years falls in the €30,000 to €40,000 price bracket (constituting 35% of the total). This band constituted less than 10% of sales back in 2003 and was then the third most popular segment: it is now ahead of all of the other segments. The €20,000 to €30,000 band (31% of the total) now falls into second place. Even the bracket at the higher end of the market, the €40,000 to €60,000 bracket has increased in popularity since 2018 (now constituting 21% of the market up from 12% in 2018).

Graph 1 – Volume of Sales by price band in Ireland in 2021 (January to October) Source: Cartell Carstat

These results clearly show that the buyer is spending more money than ever before on their new car. Reasons for this may include:

- Expensive models: Consumers may be opting for more expensive vehicles, or more expensive vehicle types like SUVs and Crossover vehicles, or MPVs

- Global Chip Shortage: Manufacturers may be prioritising the sale of higher-end models and/or increasing prices owing to the global chip shortage which impacted the market for much of 2021

- Affluence: Buyers may have more cash to spend or more available lines of credit. Financial products such as Personal Contract Plans (PCPs) came to prominence in Ireland during the recession as manufacturers sought a means to provide direct lines of credit to potential buyers

- Larger cars: Buyers may want larger cars. The country had a recorded population of 4.23 million in Census 2006 which increased to 4.76 million in Census 2016. This increase may have weighed on buyer decisions, for instance, buyers with younger children may need additional space

- Manufacture: Vehicles are more expensive to manufacture, to comply with NCAP safety ratings, for example, this increases the cost of manufacture: the buyer now often expects certain higher specification items as standard too – larger wheels, alloys, on-board technology, Advanced Driver Assistance Systems (ADAS) features – which all increase the manufacture cost

- EVs and PHEVs: Increased consumer demand for electric and hybrid vehicles (where technology is more expensive to implement) could be making an impact, along with changes in buyer habits to more environmentally friendly vehicles, and guided generally by the move to city-clean air policies.

John Byrne, Cartell.ie says:

“This is the first time that the €30,000 to €40,000 segment is the strongest selling tier of the market. Certainly cars are laden with technology including the roll-out of Advanced Driver Assistance Systems Features (ADAS): this adds to the cost of manufacture of the vehicle but it also means new cars are surely the safest they’ve ever been.”